Crypto Market Outlook 2026: Key Developments and Predictions to Watch

Updated: January 1, 2026 — concise analysis and actionable takeaways for investors and crypto enthusiasts.

- Introduction

- Key Stories for the Crypto Market Outlook 2026

- 1. Massive Liquidity Injections Expected to Boost Bitcoin Price

- 2. Trump Media to Distribute New Digital Tokens to Shareholders

- 3. XRP Seen as Key to Cross-Border Payments with Potential for Major Breakout

- 4. Altcoin Pepenode Prepares for Presale Launch

- 5. Mantle (MNT) Price Faces Potential Downtrend Amid Weekly Drops

- Market Analysis: Crypto Market Outlook 2026

- Conclusion — How to Use This Crypto Market Outlook 2026

- FAQ — Common Questions About the 2026 Crypto Market

Introduction

The crypto market outlook 2026 arrives amid shifting regulations, fresh liquidity flows, and advancing blockchain infrastructure. This crypto market outlook 2026 review synthesizes late-2025 headlines and early-2026 developments to give investors practical insights on Bitcoin, Ethereum, XRP, altcoins, and sector-wide trends.

Read on for key stories, market analysis, and a short FAQ to help you navigate the evolving digital asset landscape.

Key Stories for the Crypto Market Outlook 2026

Below are the top stories driving the crypto market outlook 2026. Use the quick bullets to jump to the full analysis.

- Massive liquidity injections and Bitcoin

- Trump Media token distribution

- XRP and cross-border payments

- Pepenode presale launch

- Mantle (MNT) potential downtrend

1. Massive Liquidity Injections Expected to Boost Bitcoin Price

Industry executives expect significant liquidity injections in 2026 that could act as a catalyst for Bitcoin and other risk-on digital assets. With lower interest rates and fiscal stimulus, investors may seek yield in crypto markets.

However, political events such as the U.S. midterms and evolving regulations could introduce short-term volatility. Monitor derivatives activity and institutional flows for early confirmation of any sustained bullish momentum.

2. Trump Media to Distribute New Digital Tokens to Shareholders

Trump Media announced plans to issue a digital token on the Cronos blockchain to DJT shareholders. The tokens are marketed as rewards and do not convey equity or voting rights.

The announcement lifted both share prices and related crypto assets. This example highlights how traditional media and public companies are experimenting with blockchain-based incentive models in 2026.

3. XRP Seen as Key to Cross-Border Payments with Potential for Major Breakout

Executives at Franklin Templeton highlighted XRP as a candidate for cross-border payment solutions, with some analysts predicting a multi-fold upside if adoption and regulatory clarity accelerate.

Institutional pilots, partnerships with remitters, and clearer guidance from regulators would be the primary catalysts for any major XRP breakout.

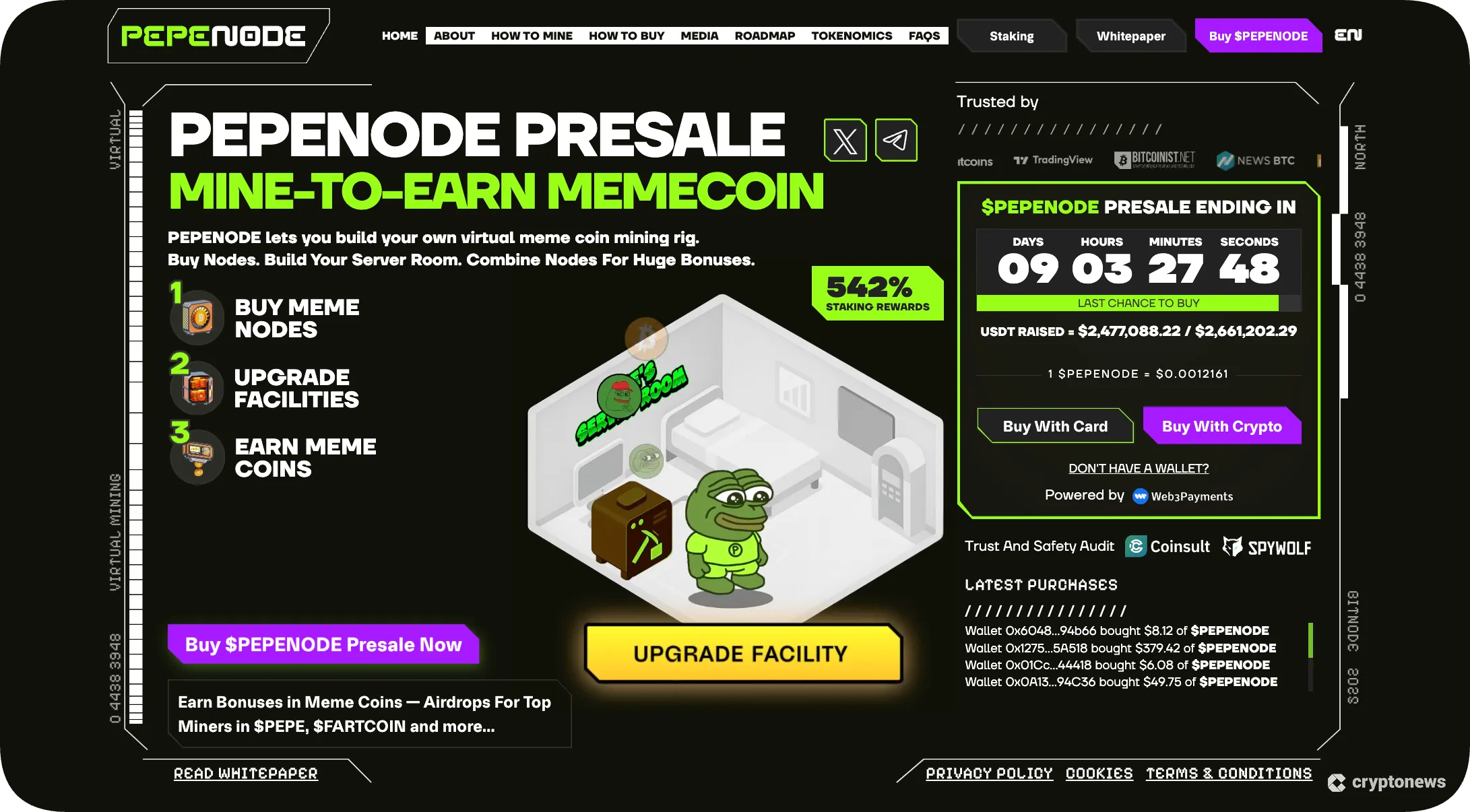

4. Altcoin Pepenode Prepares for Presale Launch

Pepenode plans a presale that targets community-driven utility and meme-token investors. Despite market headwinds, community tokens continue to find pockets of demand.

As always, evaluate tokenomics, vesting schedules, and on-chain liquidity before participating in any presale.

5. Mantle (MNT) Price Faces Potential Downtrend Amid Weekly Drops

Mantle (MNT) fell roughly 8% in a recent week, prompting analysts to watch key support levels for signs of a deeper sell-off versus a short-term correction.

Traders should combine on-chain metrics, macro sentiment, and cross-market correlations when assessing MNT’s next moves.

Market Analysis: Crypto Market Outlook 2026

The market ended 2025 with mixed signals. Bitcoin showed resilience despite a roughly 30% drawdown from prior peaks, while institutional investors increasingly used derivatives to generate yield, which reduced volatility.

Ethereum traded below $3,000 with subdued fees and limited ETF inflows, signaling short-term stagnation. At the same time, altcoins such as Solana and XRP recorded larger swings, reflecting differentiated narratives across projects.

Regulatory policy remains the leading tail risk. Coinbase executives cautioned that unclear stablecoin rules could result in competitive disadvantages versus sovereign digital currencies such as China’s digital yuan.

Overall, the crypto market outlook 2026 appears to be one of cautious optimism: continued innovation in decentralized finance (DeFi), institutional interest, and clearer regulatory frameworks could support growth, while political and macroeconomic shocks may intermittently increase volatility.

Conclusion — How to Use This Crypto Market Outlook 2026

This crypto market outlook 2026 highlights both opportunity and risk. Key items to watch include liquidity injections, regulatory clarity, token airdrops, and institutional adoption of blockchain-backed products.

Actionable takeaways:

- Monitor institutional flows and derivatives open interest for Bitcoin signals.

- Assess regulatory updates weekly to anticipate policy-driven volatility.

- Perform due diligence on presales and tokenomics before allocating capital.

- Use risk management: position sizing, stop-losses, and portfolio diversification across spot, staking, and liquid strategies.

Staying informed and adaptable will be essential to capitalize on trends emerging in this crypto market outlook 2026.

Want regular updates? Subscribe for weekly market briefs and alerts.

FAQ — Common Questions About the 2026 Crypto Market

Q: Will Bitcoin benefit from the expected liquidity injections?

A: Potentially yes. Liquidity injections can lift risk assets including Bitcoin, but outcomes depend on timing, regulatory responses, and macro sentiment. Watch institutional flows and options/ETF activity for confirmation.

Q: Are token airdrops like Lighter and corporate token distributions meaningful?

A: Large airdrops can significantly affect liquidity and user behavior. Corporate token rewards are often marketing and engagement tools, not equity. Evaluate utility, supply mechanics, and on-chain distribution before treating them as investment signals.

Q: What should I watch for with XRP in 2026?

A: Key drivers include regulatory clarity, institutional partnerships in cross-border payments, and integration with remittance corridors. Positive developments could spur outsized gains, while regulatory hurdles may cap upside.

コメント