Crypto Market Update: Bitcoin Surges, Binance Returns to Stock Tokens, XRP Eyes $2.50

Published: January 2026 — Primary topic: crypto market update

Introduction

This crypto market update highlights major moves across digital assets as 2026 progresses. Bitcoin has surged toward $91,000 amid suspected Bank of Japan intervention, Ethereum shows rising on-chain activity, and Binance plans to reintroduce tokenized stock trading.

Meanwhile, Ripple (XRP) gained momentum after a $29 million partnership in Turkey, with forecasts eyeing $2.50. Read on for concise analysis, key stats, and what these developments mean for investors.

Crypto Market Update: Key Stories

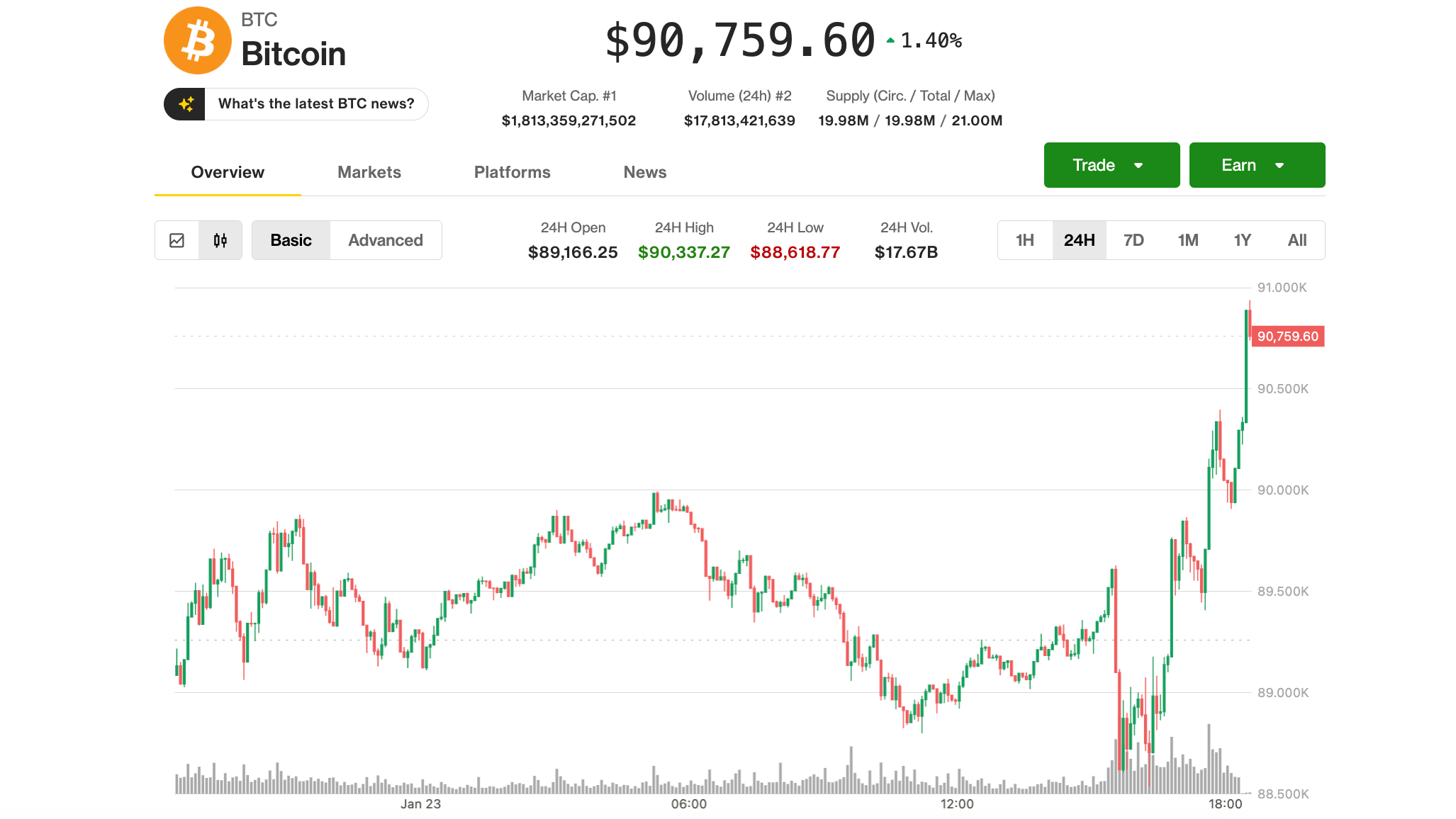

Bitcoin Surges to ,000 on Suspected Bank of Japan Intervention

Bitcoin (BTC) has rallied sharply, approaching $91,000. Analysts link the move to possible Bank of Japan liquidity actions and renewed investor confidence.

However, spot Bitcoin ETF outflows signal short-term profit-taking and potential volatility.

Key point: BTC’s momentum suggests upside potential, but watch ETF flows and macro signals closely.

Binance Plans to Reintroduce Tokenized Stock Trading

Binance confirmed plans to resume tokenized stock trading after pausing such offerings in 2021 due to regulatory pressure.

The move aims to bridge traditional equities and blockchain-based tokens for retail and institutional users.

This relaunch reflects improving regulatory clarity and strong investor demand for tokenization of assets.

Ripple (XRP) Eyes .50 After Million Turkish Deal

Ripple expanded in Turkey through a $29 million partnership with Garanti BBVA, boosting XRP’s utility for cross-border payments and remittances.

Analysts suggest this partnership could drive adoption and upward price pressure toward $2.50 if usage grows.

SEC Dismisses Lawsuit Against Gemini Over Earn Product

The SEC dismissed its suit against Gemini over the Earn product after customers were reimbursed via the Genesis bankruptcy process.

This development may reduce regulatory uncertainty for lending products, although oversight remains dynamic.

French Crypto Tax Platform Waltio Hit by Data Breach Affecting 50,000 Users

Waltio reported a data breach impacting roughly 50,000 users, with ransom demands attributed to the Shiny Hunters group.

The incident highlights persistent cybersecurity risks for platforms holding sensitive crypto tax and financial data.

Market Analysis

Bitcoin’s push toward $91,000 reflects favorable macro liquidity and risk-on sentiment. Yet, ETF outflows and short-term profit-taking are signs of caution.

Ethereum shows rising on-chain activity, supported by lower fees and renewed developer momentum.

Binance’s tokenized stocks relaunch could accelerate tokenization adoption and create new liquidity pools across crypto and traditional finance.

Ripple’s Turkey expansion underscores the value of real-world use cases—especially in remittances and cross-border rails.

Regulatory clarity improved in some areas (e.g., Gemini decision), but security incidents like Waltio remind investors to prioritize custody and platform risk management.

Key Takeaways & Actionable Insights

- Monitor BTC ETF flows: they can signal near-term volatility despite bullish momentum.

- Watch tokenization trends: Binance’s move could spur new product innovation and trading volumes.

- Prioritize security: use hardware wallets, strong KYC/AML-aware platforms, and regular audits.

- Focus on use cases: real-world partnerships (like Ripple in Turkey) matter for long-term adoption.

FAQ — Frequently Asked Questions

Will Bitcoin reach 0,000 in 2026?

No definitive timeline exists. Bitcoin near $91,000 shows strong momentum, but market-moving events, ETF flows, and macro policy will determine whether $100,000 is reached.

Consider risk management and diversification.

Are tokenized stocks regulated?

Regulation varies by jurisdiction. Binance’s relaunch suggests growing regulatory clarity in some markets, but investors should verify legal status and custody protections in their region.

How should I respond to the Waltio breach?

If affected, follow official Waltio instructions, change passwords, enable MFA, and monitor for suspicious activity. Use cold storage for long-term holdings and minimize platform exposure.

Conclusion

This crypto market update shows a sector balancing rapid price action, product innovation, and evolving regulatory and security challenges.

Bitcoin’s momentum, Binance’s strategic relaunch, and Ripple’s regional growth all point to a maturing market with expanding real-world use cases.

Stay informed, prioritize security, and size positions according to your risk tolerance. For real-time price tracking and alerts, consider using reputable portfolio tools.

Want timely updates? Subscribe to our crypto newsletter for daily market briefs, alerts, and expert analysis.

コメント