Crypto Market Update – November 25, 2025

Introduction

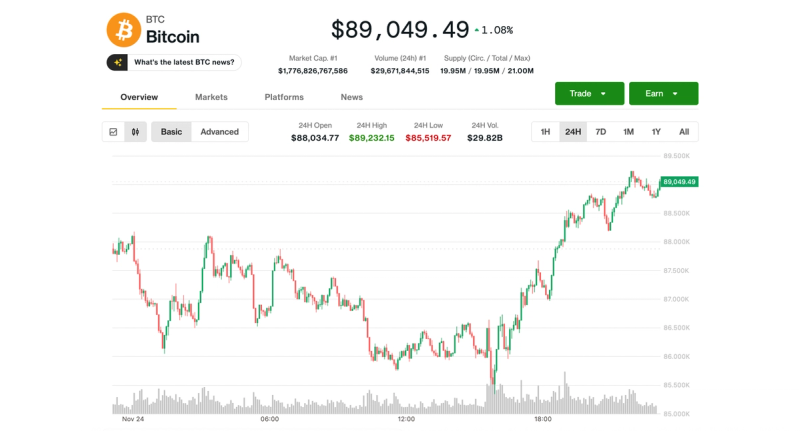

The cryptocurrency market showed renewed vigor on November 25, 2025, as Bitcoin surged past $89,000 amidst a relief rally led by XRP and SUI. Institutional interest intensified with the launch of XRP ETFs by Franklin Templeton and Grayscale. Additionally, major tech investments in AI infrastructure by Amazon fueled a surge in crypto mining stocks. This article synthesizes the most significant developments and provides market insights.

Key Stories

-

XRP and SUI Lead Crypto Rebound; Bitcoin Crosses $89K

Bitcoin reclaimed a critical threshold above $89,000, with traders eyeing resistance near $100,000. Market optimism was bolstered by commentary from San Francisco Fed President Mary Daly, increasing expectations for a December rate cut.

Image credit: CoinDesk -

Exodus Acquires Baanx and Monavate for $175 Million

The publicly listed crypto wallet provider Exodus expanded its footprint by acquiring W3C Corp, the parent company of crypto card and payment firms Baanx and Monavate, aiming to enhance wallet capabilities.

Image credit: CoinDesk -

TON Token Rallies 8% on Telegram Ecosystem Expansion with AI and Tokenized Stocks

The Telegram-originated TON token surged following the launch of Confidential Compute Open Network (COCOON) and integration of tokenized US stocks and digital collectibles, signaling ecosystem growth.

Image credit: CoinDesk -

Franklin Templeton Joins XRP ETF Race, Viewing It as Foundational to Global Finance

With XRP ETFs debuting on NYSE Arca, Franklin Templeton joins other financial heavyweights betting on crypto’s growing role in global payments infrastructure.

Source: CoinTelegraph -

Amazon Invests $50 Billion into AI Infrastructure, Boosting Bitcoin Miners

Amazon’s major investment in AI and high-performance computing infrastructure has driven a surge in crypto miners’ stocks, with Bitcoin price bouncing back above $87,000.

Image credit: CoinDesk

Market Analysis

Bitcoin’s rebound from a recent low near $80,000 to above $89,000 signals a potential market bottom, supported by heightened institutional participation. CME’s crypto futures volume surged 132% year-over-year, with open interest up 82%, indicating rising demand from both retail and institutional investors.

Altcoins like XRP, TON, and Filecoin have demonstrated resilience, driven by key technological upgrades and new ETF listings. The launch of multiple XRP ETFs by industry giants Franklin Templeton and Grayscale further legitimizes digital assets in mainstream finance.

Nonetheless, market volatility persists amid macroeconomic uncertainties and regulatory developments. Investors are advised to maintain cautious optimism, balancing risk management with awareness of evolving market fundamentals.

Conclusion

The crypto market on November 25, 2025, is characterized by a strong Bitcoin recovery and significant institutional ETF activity, signaling growing maturity and acceptance of digital assets. While challenges remain, including regulatory scrutiny and macroeconomic risks, the market’s technical and fundamental indicators suggest a cautiously optimistic outlook for the near term.

コメント