Cryptocurrency Market Update – January 10, 2026

Published: January 10, 2026

Introduction

The cryptocurrency market continues to show dynamic movement as we enter 2026, with regulatory changes, institutional innovations, and notable price action in major digital assets like Bitcoin and Ethereum shaping market direction. In this update, we summarize top stories from January 9–10, 2026 and highlight implications for traders, investors, and institutions tracking the crypto market.

Key Stories — Market, Regulation & Institutional Moves

1. Bitcoin’s Price Dynamics and Rally Prospects

Bitcoin has been holding near $90,000 with futures-led rallies pushing intraday highs to $95,000. Analysts say the setup shows retests of support and potential for a rally toward $101,500 if momentum holds. Technical indicators such as the RSI flipped bullish on several timeframes, signaling renewed strength in the broader cryptocurrency market.

Key takeaways:

- Short-term consolidation near $90K; signs of accumulation by long-term holders.

- Futures and institutional flows remain important drivers for near-term direction.

- Watch support and resistance zones closely for a futures-led breakout.

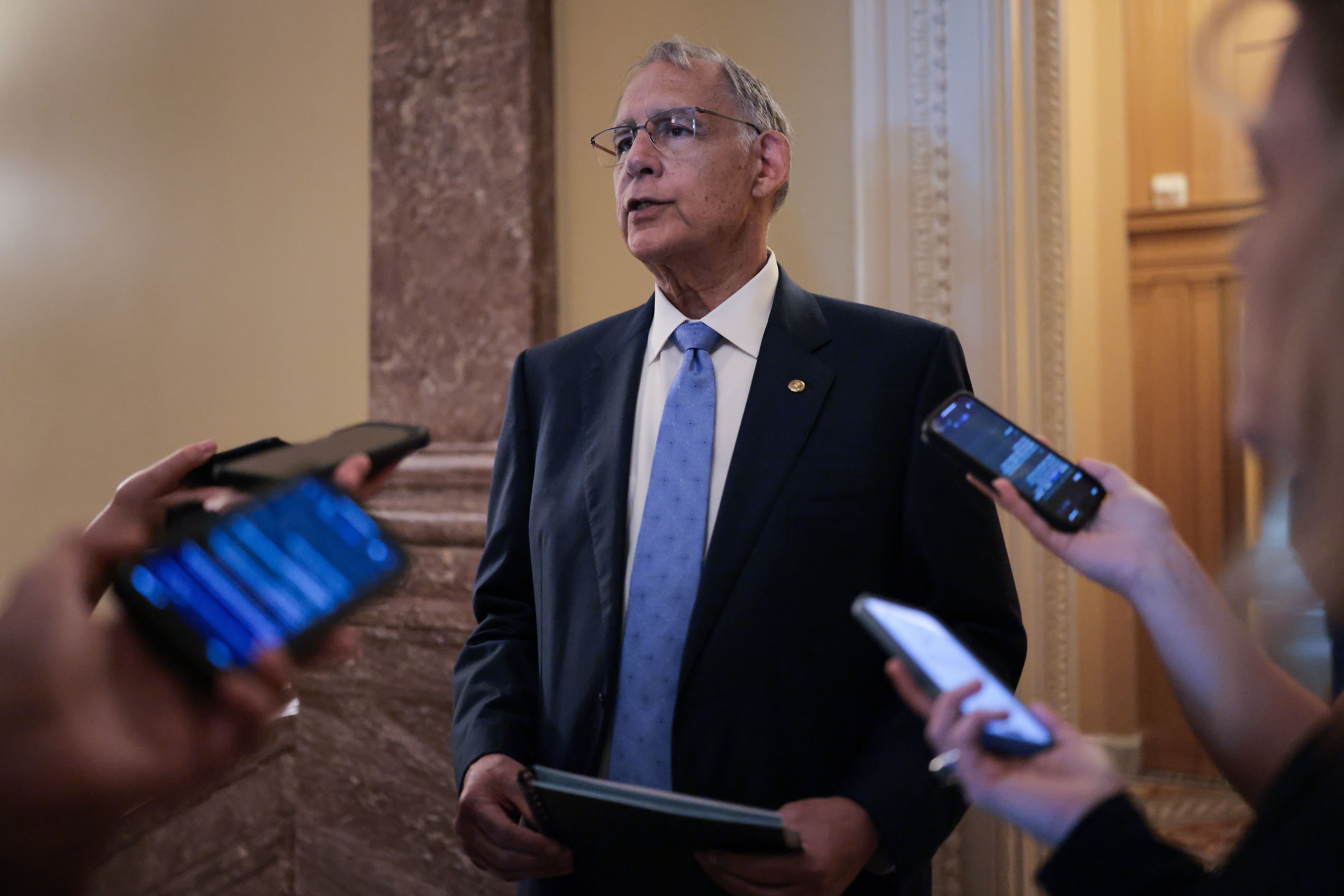

2. U.S. Senate Crypto Market Structure Bill Faces Bipartisan Challenges

Senate Republicans are pushing to vote on a draft crypto market structure bill, but bipartisan buy-in is uncertain. Democrats want strict ethics safeguards to prevent elected officials from financially benefiting from crypto, especially in prediction markets. The bill’s progress will materially affect regulatory clarity for the U.S. cryptocurrency market.

3. Institutional Innovations: BNY Mellon Launches Tokenized Deposits

BNY Mellon rolled out tokenized deposits for institutional clients using a private, permissioned ledger to mirror deposit balances. This initiative aims to speed settlement and unlock liquidity in traditional finance, reflecting deeper integration between TradFi and the cryptocurrency market.

4. Ripple Gains UK Regulatory Approval

Ripple’s UK arm secured registration with the Financial Conduct Authority as an Electronic Money Institution. This regulatory milestone enables Ripple to expand compliant payment services in the UK and signals growing mainstream acceptance for crypto firms within regulated frameworks.

5. Growing Concerns Over Prediction Market Ethics

After a suspicious $400,000 bet tied to Venezuelan politics, U.S. lawmakers proposed banning politically related prediction market bets. The proposal aims to curb insider trading and uphold ethics in crypto-enabled prediction markets, which are increasingly part of the broader cryptocurrency market debate.

Market Analysis

The cryptocurrency market is cautiously optimistic as Bitcoin consolidates near $90,000. Volume is mixed and altcoins are showing divergent trends. Institutional activity is pivotal: ETF flows turned negative recently, while long-term holder sell pressure has eased.

Further notes:

- Institutional adoption and tokenization projects (e.g., tokenized deposits) are structural positives for market liquidity and settlement.

- Regulatory clarity, such as the UK FCA’s approval for Ripple, reduces uncertainty in some regions but legislative debates in the U.S. remain a headwind.

- Watch global enforcement trends in Colombia and South Korea for implications on exchange operations and tax reporting.

Overall, the setup suggests potential upside if momentum continues, but traders should manage risk given ongoing regulatory developments that can quickly change sentiment in the cryptocurrency market.

Conclusion

As 2026 unfolds, the cryptocurrency market is navigating a complex interplay of price action, regulatory scrutiny, and institutional adoption. Bitcoin’s resilience near $90,000 and improving technicals point to possible bullish momentum, while pending legislation and ethics debates emphasize the need for regulatory clarity.

Investors and stakeholders should monitor legislative outcomes, institutional product rollouts, and on-chain signals closely to capitalize on opportunities while managing downside risk.

Quick actions:

- Follow regulatory updates in your jurisdiction.

- Watch Bitcoin support/resistance and futures-led volume.

- Consider custody and compliance when evaluating institutional products.

Ready for deeper coverage? Subscribe to real-time alerts or bookmark this page to stay informed on the evolving cryptocurrency market.

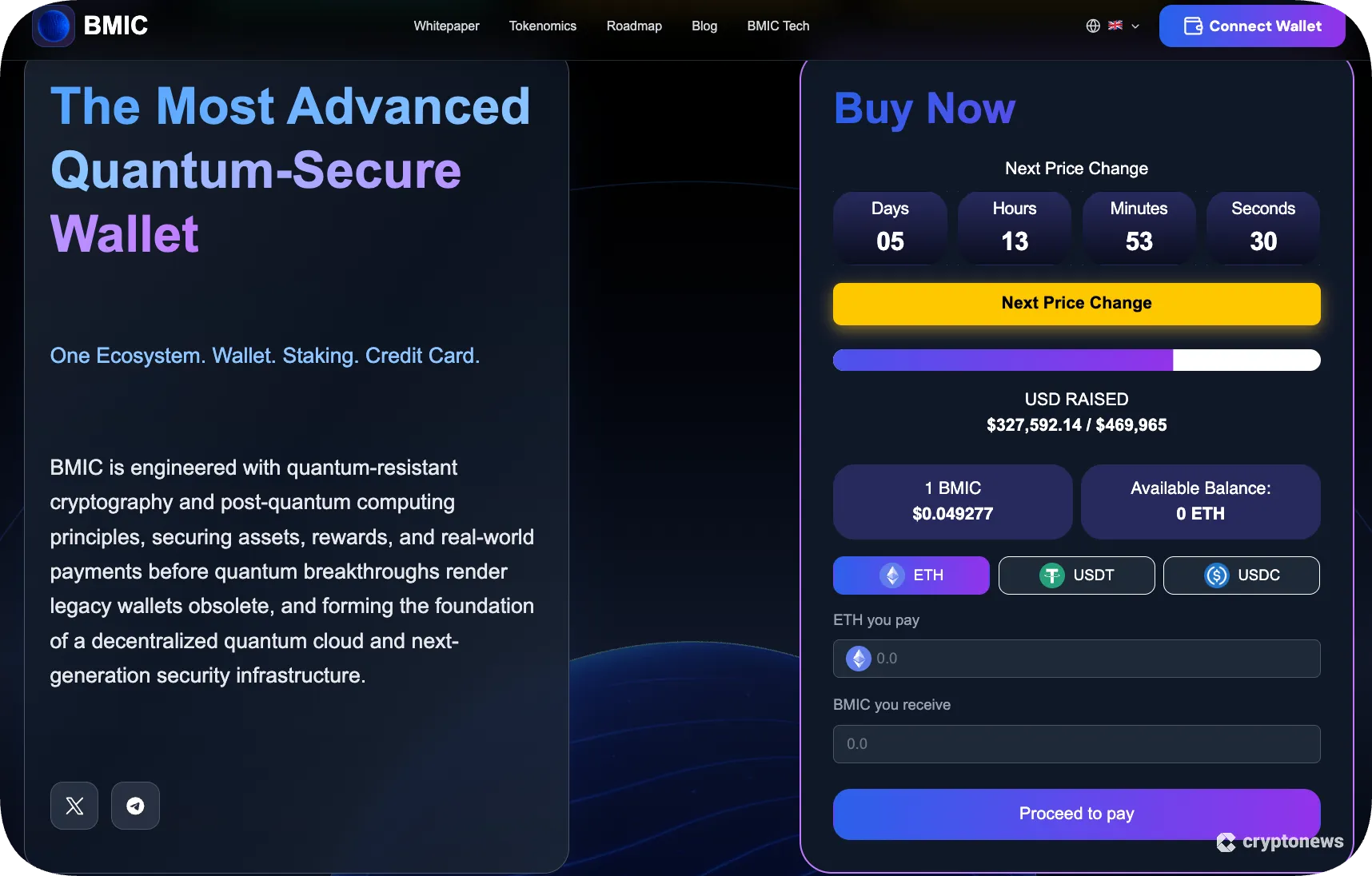

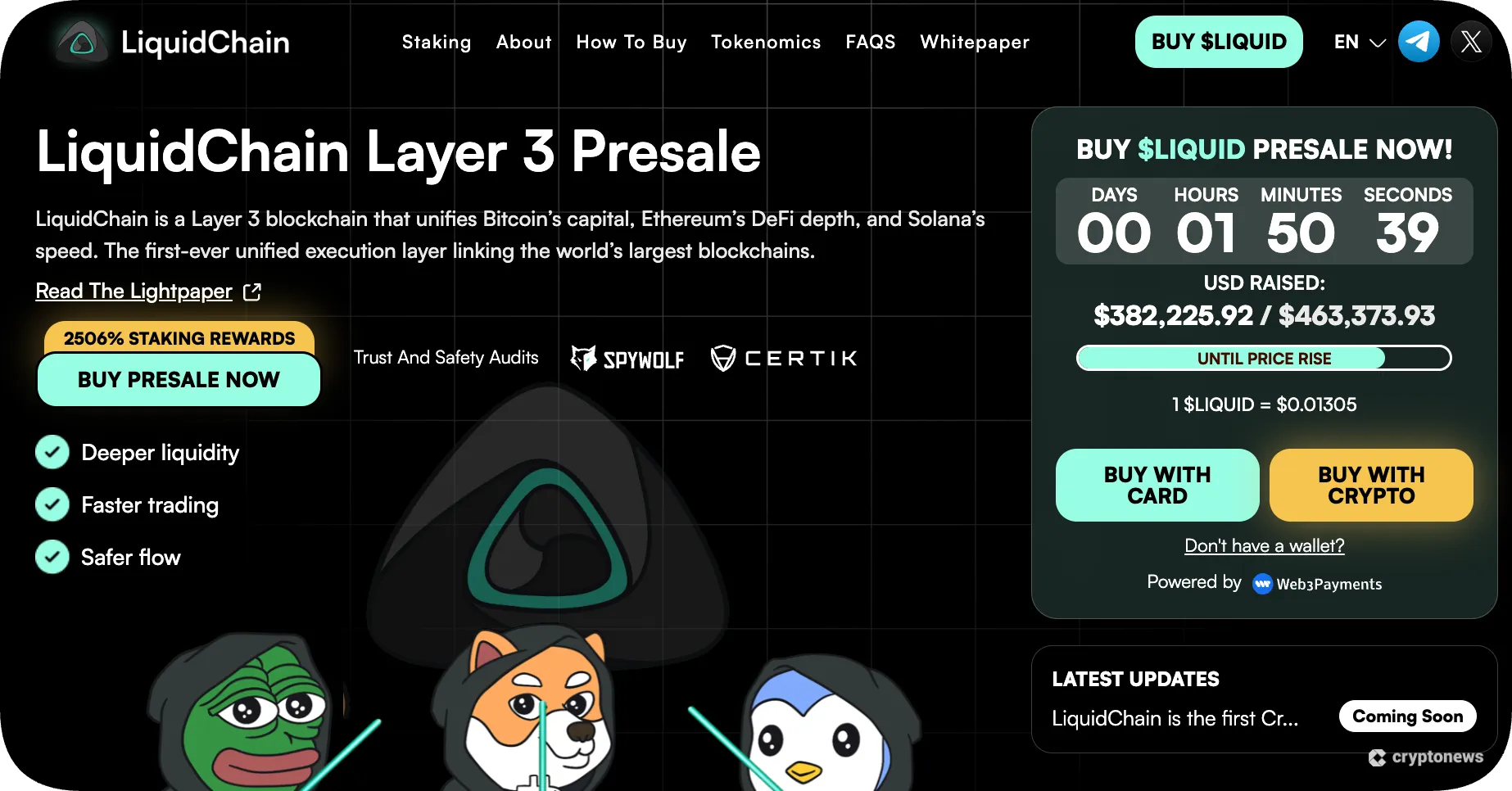

Additional Images & Emerging Tokens

コメント