Cryptocurrency Market Update – January 15, 2026

Timely market summary, price action, and regulatory developments shaping crypto on Jan 15, 2026.

Introduction

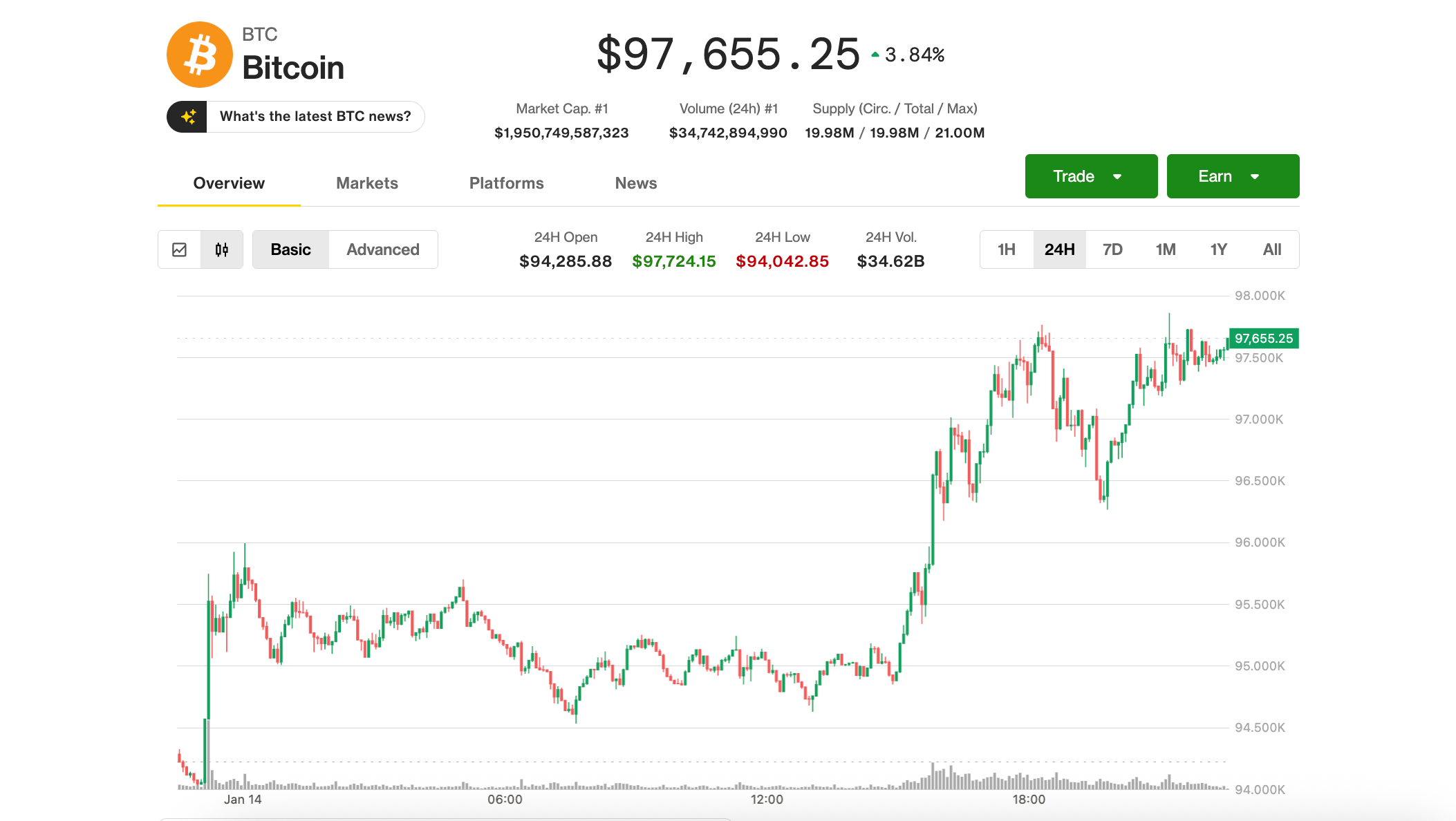

Cryptocurrency market update: As we step into 2026, the cryptocurrency market is showing strong momentum with significant price rallies, regulatory developments, and innovative blockchain projects reshaping the landscape. Bitcoin recently surged past $97,000, reigniting bullish sentiment, while Ethereum and other altcoins are showing promising technical patterns. This cryptocurrency market update synthesizes the most important and trending stories from the crypto space as of January 15, 2026.

Main News: Key Headlines in this Cryptocurrency Market Update

-

Bitcoin and Ether’s Sharp Breakouts Trigger Massive Liquidations

Bitcoin broke above the $95,000 resistance mark, reaching highs above $97,500. This breakout liquidated nearly $700 million in short positions and boosted risk appetite among investors. Renewed inflows into spot Bitcoin ETFs and increased interest from U.S. institutional investors are reversing late-2025 cautious trading trends.

Ethereum also experienced sharp gains, bolstered by strengthening fundamentals despite a lagging price. Watch on-chain metrics and ETF flows for confirmation of sustained momentum.

Source: CoinDesk -

Regulatory Relief for Zcash Foundation in SEC Probe

The Zcash Foundation received a clean bill of health as the SEC closed its multi-year investigation without enforcement action. This development eases uncertainty for privacy coin advocates and affects regulatory sentiment across privacy-focused tokens.

Image credit: CryptoNews -

Ripple’s XRP Surpasses as Institutional Interest Grows

XRP has surged past $2, driven by strong institutional inflows and regulatory progress that help Ripple scale payments across Europe. Chart patterns and volume suggest the rally could extend, with analysts eyeing further upside in 2026.

Image credit: CryptoNews -

Mantra Blockchain Restructures After OM Token Collapse

Mantra, a real-world asset blockchain project, announced staff reductions and restructuring after its OM token collapsed in 2025. The team aims to stabilize operations and refocus the business model amid market pressure.

Image credit: CryptoNews -

BonkFun Slashes Creator Fees to 0% to Revive Meme Coin Launchpad Wars

BonkFun cut creator fees to 0% to reignite the meme coin launchpad competition. This aggressive fee move aims to attract more creators and projects and could intensify competition in the meme coin ecosystem.

Image credit: CryptoNews

Market Analysis & Insights — This Cryptocurrency Market Update Explained

The overall market sentiment is bullish as Bitcoin consolidates near its 2026 highs above $97,000. Key support levels have held firm, and short liquidations have fueled upward momentum.

- Price action: Bitcoin’s breakout above $95k/$97k triggered large short squeezes and renewed ETF inflows.

- Ethereum fundamentals: A divergence between price and on-chain fundamentals suggests potential for further price appreciation as network upgrades and DeFi activity increase.

- Institutional adoption: Spot Bitcoin ETF inflows and Ripple’s European expansion signal growing institutional participation.

- Regulatory backdrop: The SEC closure of the Zcash probe without penalties is a positive regulatory datapoint for privacy coin projects.

- Altcoin rotation: Capital rotation into privacy coins and selective DeFi projects is noticeable after governance issues in competing platforms.

Investors should monitor ETF flow data, on-chain metrics (active addresses, fees, TVL), and regulatory announcements to confirm whether this rally is sustainable.

Conclusion

The cryptocurrency market in early 2026 is characterized by strong price rallies, institutional interest, and evolving regulatory clarity. Bitcoin and Ethereum are leading the charge, while altcoins and blockchain projects navigate challenges and opportunities. This cryptocurrency market update highlights the importance of watching ETF momentum, regulatory updates, and project-specific developments to gauge the market trajectory in 2026.

FAQ — Common Questions in This Cryptocurrency Market Update

Why did Bitcoin spike above ,000?

The spike was driven by a breakout above key resistance, liquidation of short positions (roughly $700M), and renewed inflows into spot Bitcoin ETFs from institutional investors.

What does the SEC closing the Zcash probe mean?

The SEC closed its multi-year probe into the Zcash Foundation without enforcement action, which reduces regulatory uncertainty for privacy-focused coins and may influence regulatory policy discussions.

Should investors chase altcoin rallies like XRP and privacy coins?

Altcoin rallies can be attractive but are higher risk. Consider position sizing, on-chain signals, regulatory developments, and project fundamentals before allocating capital.

コメント