- Cryptocurrency Market Update – November 25, 2025

- Introduction

- Key Stories

- SGX Launches Bitcoin and Ethereum Perpetual Futures with Million Volume

- Swedish Fintech Klarna to Issue Stablecoin via Stripe’s Bridge

- Japan’s Financial Services Agency to Mandate Liability Reserves for Crypto Exchanges

- Exodus Acquires W3C Corp for 5 Million, Expanding Onchain Payment Solutions

- XRP Surges 7% as Ripple-Linked ETFs Go Live

- Market Analysis

- Conclusion

Cryptocurrency Market Update – November 25, 2025

Introduction

The cryptocurrency market on November 25, 2025, experienced significant developments spanning new financial products, regulatory shifts, and corporate acquisitions. Bitcoin and Ethereum led the resurgence, supported by growing institutional interest and evolving regulatory frameworks across Asia, Europe, and the Americas. This article highlights the key stories making waves today and analyzes the current market dynamics.

Key Stories

SGX Launches Bitcoin and Ethereum Perpetual Futures with Million Volume

Singapore Exchange (SGX) debuted perpetual futures contracts for Bitcoin and Ethereum, recording nearly 2,000 lots traded on day one, equating to approximately $35 million in notional value. This launch marks a pivotal expansion of crypto derivatives in the Asian market.

Swedish Fintech Klarna to Issue Stablecoin via Stripe’s Bridge

Klarna, the Swedish buy-now-pay-later giant, announced plans to launch a stablecoin on Stripe’s Bridge platform atop the upcoming Tempo blockchain. The stablecoin is expected to debut in 2026, enhancing Klarna’s digital banking offerings.

Japan’s Financial Services Agency to Mandate Liability Reserves for Crypto Exchanges

The Japanese FSA is set to require crypto exchanges to maintain liability reserves to protect users against risks such as hacks. This regulatory move aims to bolster consumer confidence and enhance market security.

Exodus Acquires W3C Corp for 5 Million, Expanding Onchain Payment Solutions

Crypto wallet provider Exodus has leveraged its Bitcoin holdings to fund the $175 million acquisition of W3C Corp, which includes crypto payment firms Baanx and Monavate. This strategic move boosts Exodus’s presence in onchain payments.

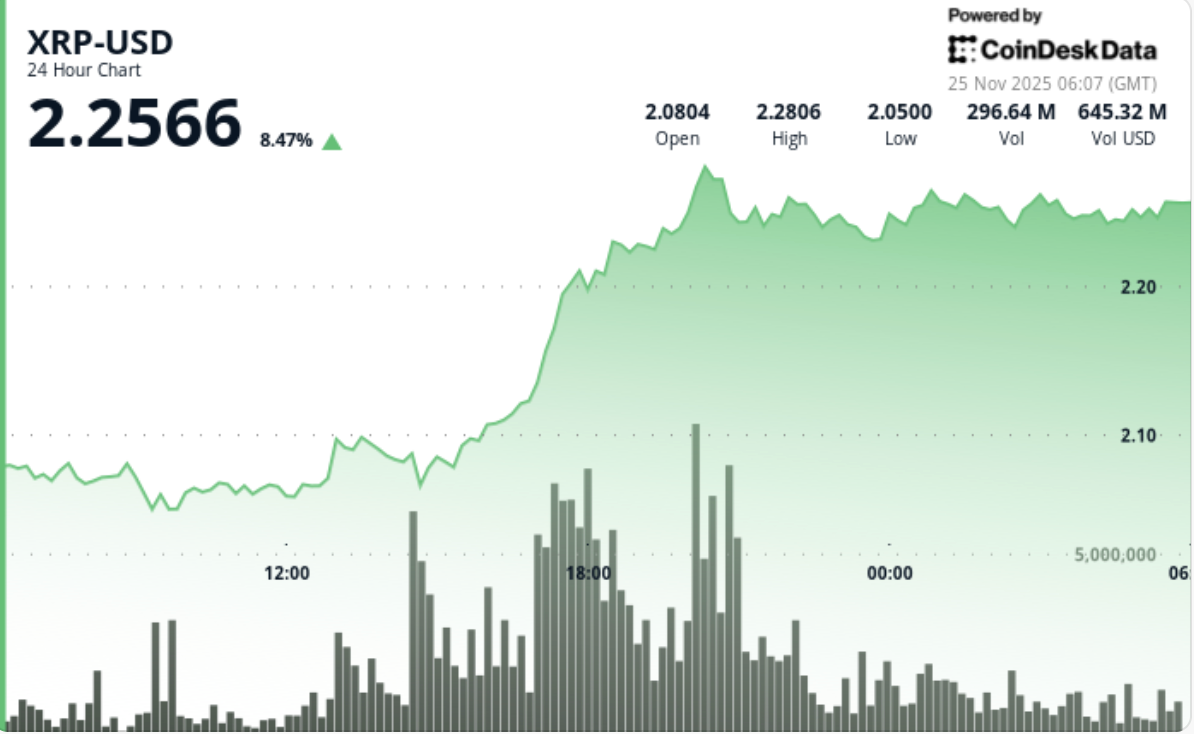

XRP Surges 7% as Ripple-Linked ETFs Go Live

XRP experienced a strong 7% price surge following the launch of Ripple-linked ETFs. Technical indicators suggest bullish momentum, with potential for further gains in the near term.

Market Analysis

Bitcoin reclaimed the $87,000 level on Tuesday, buoyed by improved risk sentiment and a strong equity market session. Major altcoins rallied alongside Bitcoin, with memecoins like DOGE benefiting from ETF debuts that signaled growing legitimacy. Despite this optimism, the CoinDesk 20 Index slipped 2% as Bitcoin Cash and Polkadot declined, reflecting mixed market breadth.

Japan’s move to require liability reserves for exchanges is expected to strengthen user protection and institutional trust, potentially attracting more cautious investors. Meanwhile, SGX’s new futures contracts and growing ETF options in the US and Europe highlight increasing institutional participation in crypto markets.

Investor focus is also on the upcoming month-end Bitcoin options expiry, valued at $13.3 billion, which may introduce volatility. The broader macroeconomic environment, including anticipated Fed policy shifts, continues to influence market direction.

Conclusion

November 25, 2025, marks a day of significant evolution for the cryptocurrency ecosystem, with regulatory enhancements, product innovations, and strategic corporate moves shaping the landscape. While Bitcoin and Ethereum maintain their central roles, emerging ETFs and stablecoin projects reflect maturation and diversification. Market participants should monitor regulatory developments and macroeconomic signals closely as they navigate the year-end period marked by elevated volatility and opportunity.

コメント