Cryptocurrency News Roundup – November 29, 2025

- Introduction

- Key Stories

- Tether Shuts Down Uruguay Mining Over Energy Tariffs

- Brazil’s São Paulo Pilots Blockchain Microloans for Farmers

- UK Government to Crack Down on Crypto Tax Avoidance Starting January

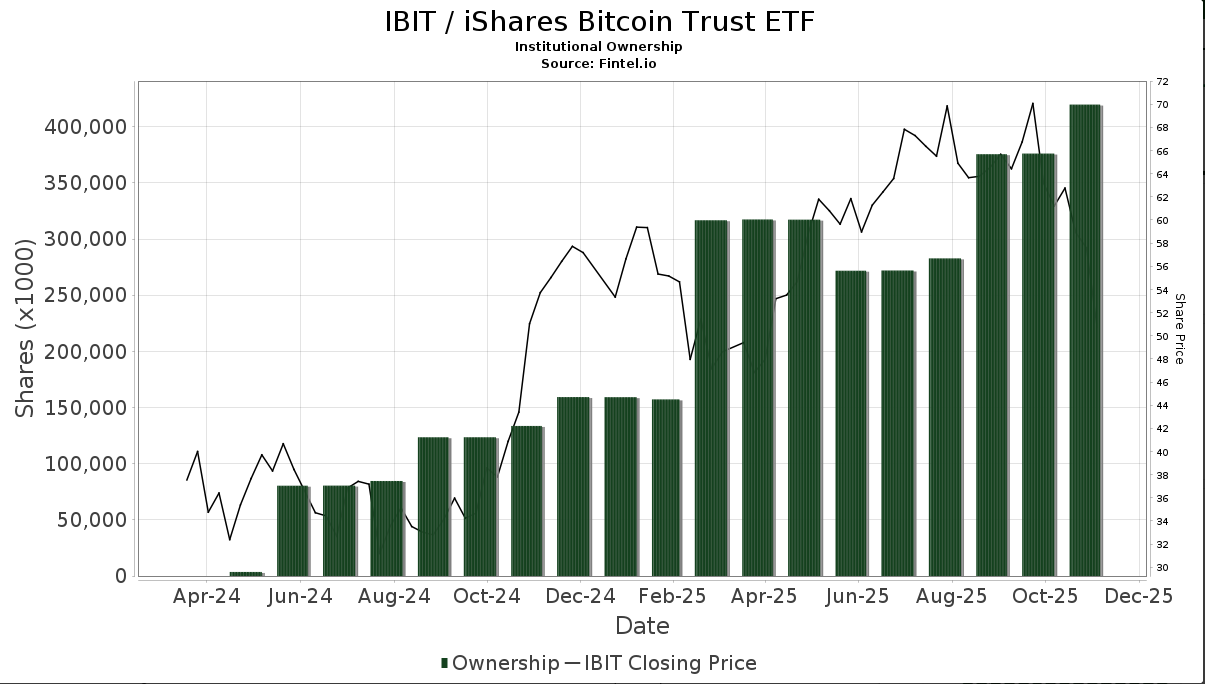

- BlackRock’s Income Fund Boosts Bitcoin ETF Holdings by 14%

- Upbit Reports 5.9 Billion Won Loss from Recent Hack, Fully Reimburses Users

- Market Analysis

- Conclusion

Introduction

The cryptocurrency landscape on November 29, 2025, is marked by significant regulatory and market developments. Tether has halted its Bitcoin mining operations in Uruguay due to rising energy costs. Brazil’s economic hub, São Paulo, is piloting blockchain-based microloans for farmers to improve financial inclusion. Meanwhile, the UK government is set to crack down on crypto tax avoidance starting January 2026. This article synthesizes these major stories and offers insight into the current crypto market trends.

Key Stories

Tether Shuts Down Uruguay Mining Over Energy Tariffs

Tether, having planned an investment of up to $500 million in Uruguay, has ceased its Bitcoin mining operations there. The decision stems from soaring energy prices and regulatory challenges. The company reportedly dismissed 30 staff amid a $4.8 million debt dispute with the local power provider UTE.

Brazil’s São Paulo Pilots Blockchain Microloans for Farmers

São Paulo is launching a pilot program using blockchain technology to provide predictable, reliable microloans to farmers. Developed with Tanssi’s blockchain infrastructure, this initiative avoids reliance on public blockchains and aims to reduce transaction costs.

UK Government to Crack Down on Crypto Tax Avoidance Starting January

From January 2026, UK crypto platforms will be required to report all domestic user activity to tax authorities, marking a significant step in global crypto tax enforcement. This move aims to curb tax evasion and increase transparency in digital asset transactions.

BlackRock’s Income Fund Boosts Bitcoin ETF Holdings by 14%

BlackRock’s Strategic Income Opportunities Portfolio increased its allocation to the iShares Bitcoin Trust by 14%, reflecting growing institutional demand for Bitcoin exposure through ETFs.

Upbit Reports 5.9 Billion Won Loss from Recent Hack, Fully Reimburses Users

South Korea’s largest crypto exchange, Upbit, disclosed a 5.9 billion won corporate loss from a recent hack but compensated all affected users from its reserves totaling 38.6 billion won.

Market Analysis

The crypto market shows cautious optimism as Bitcoin recovered to around $92,000, yet broader downtrend pressures persist. Hedera Hashgraph (HBAR) rose 2.5%, buoyed by institutional inflows and bullish derivatives positioning. Notably, Bitcoin dominance is behaving unusually by decreasing during a 30% market correction, reflecting complex deleveraging dynamics.

Market sentiment for December rate cuts has surged, with prediction markets indicating an 87% probability of a Fed rate reduction, fueling gains in crypto-related stocks like Cleanspark and Riot. Conversely, altcoins such as DOGE and XRP face bearish pressures, with XRP at risk of dropping to $1.50 unless it reclaims $2.20 resistance.

Ethereum’s largest ICO-era whales have cashed out $60 million after massive gains but continue buying overall, signaling sustained bullish sentiment. Stablecoin supply on Ethereum’s ERC-20 remains at record highs, a classic bullish indicator despite recent market pullbacks.

Conclusion

On November 29, 2025, the cryptocurrency sector is navigating a complex mix of regulatory tightening and technological progress. Tether’s withdrawal from Uruguay underscores the impact of operational costs, while Brazil’s blockchain microloan pilot highlights innovative financial inclusion efforts. The UK’s new tax measures demonstrate the growing governmental focus on crypto compliance. Market volatility remains, influenced by macroeconomic factors and institutional moves. Investors should stay informed on regulatory updates and market signals as 2026 approaches.

コメント