Cryptocurrency News Today — Bitcoin support near $80,000 (December 14, 2025)

Top crypto headlines: Bitcoin support near $80,000, institutional index moves, Tether’s high-profile bid, and major bank allocation guidance as markets shift into 2026.

- Introduction

- Main News

- 1. Bitcoin Finds Strong Support Near ,000

- 2. Strategy Survives First Nasdaq 100 Shakeup

- 3. Tether’s .1 Billion Bid to Acquire Juventus Football Club Rejected

- 4. Vanguard Executive Calls Bitcoin a ‘Digital Labubu’ but Opens ETF Trading

- 5. Brazil’s Largest Private Bank Recommends Up to 3% Bitcoin Allocation

- Market Analysis

- Conclusion

- FAQ

Introduction

The cryptocurrency market continues to evolve rapidly as we approach the end of 2025. Today’s top stories include Bitcoin support near $80,000, institutional strategies holding steady in major indexes, high-profile bids in the crypto sports sponsorship space, and regulatory and market developments shaping digital assets. This article synthesizes insights from CoinDesk, CoinTelegraph, and CryptoNews to give a concise, actionable view of today’s crypto landscape.

Main News

Quick summary:

- Bitcoin support near $80,000 validated by on-chain demand and cost-basis metrics.

- Strategy remains in the Nasdaq 100 after the rebalance.

- Tether’s $1.1B bid for Juventus was rejected.

- Vanguard opens ETF trading while expressing caution.

- Itau recommends up to 3% Bitcoin allocations for clients.

1. Bitcoin Finds Strong Support Near ,000

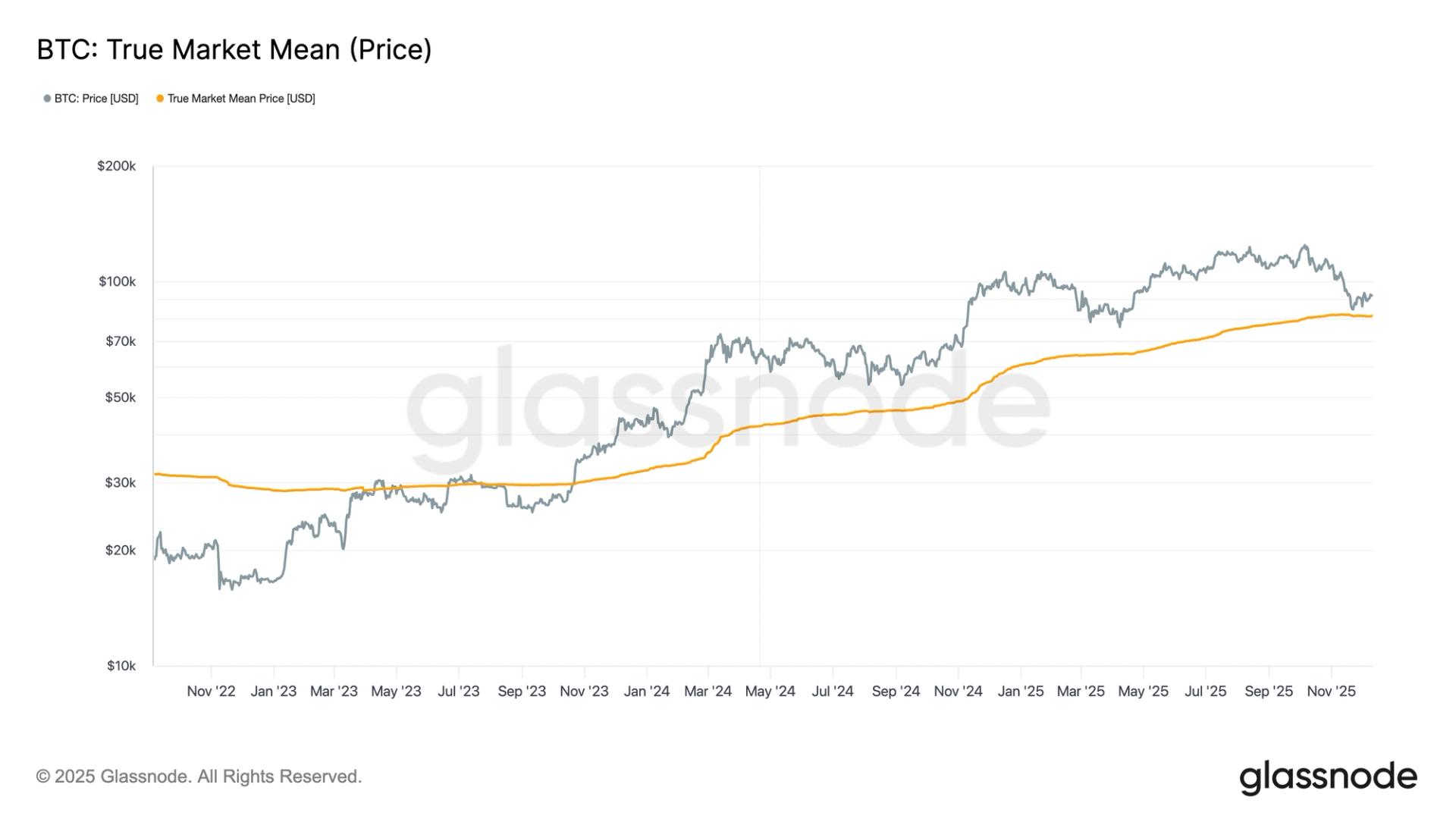

On-chain data highlights Bitcoin support near $80,000 as resilient demand appears around this price level. Multiple cost-basis metrics and accumulation by long-term holders confirm investor conviction, indicating a solid support zone that could underpin future rallies. These signals are supported by lower exchange outflows and sustained ETF inflows in recent sessions.

2. Strategy Survives First Nasdaq 100 Shakeup

Bitcoin-treasury company Strategy kept its spot in the Nasdaq 100 following the latest annual rebalance, even as six firms were dropped and three were added. The decision highlights growing acceptance of digital-asset holdings within mainstream indices, while MSCI debates stricter rules for firms with heavy crypto exposure.

3. Tether’s .1 Billion Bid to Acquire Juventus Football Club Rejected

Stablecoin issuer Tether, which holds a 10% stake in Juventus FC, reportedly offered $1.1 billion in cash to Exor for the majority stake. Exor declined, retaining control. The episode signals crypto capital’s increasing interest in sports and entertainment investments, even if deals remain contested.

4. Vanguard Executive Calls Bitcoin a ‘Digital Labubu’ but Opens ETF Trading

Vanguard has enabled client access to Bitcoin ETFs, yet a senior executive described Bitcoin as a “digital labubu” — a skeptical take that underscores the firm’s cautious position. Despite this rhetoric, offering ETF access marks a pragmatic shift toward meeting investor demand for regulated crypto exposure.

5. Brazil’s Largest Private Bank Recommends Up to 3% Bitcoin Allocation

Itau Asset Management advised a portfolio allocation of up to 3% to Bitcoin as a hedge against currency risk and inflation. This guidance aligns with a broader trend of mainstream asset managers incorporating regulated Bitcoin products into diversified strategies.

Market Analysis

Key takeaway: Bitcoin support near $80,000 acts as a structural floor validated by on-chain metrics and investor behavior. If macro conditions stabilize, this support could catalyze renewed upward momentum.

That said, mixed institutional signals — from cautious comments at Vanguard to continued listings of crypto treasuries in major indices — show adoption is advancing while sentiment remains guarded. Strategy’s retention in the Nasdaq 100 is a bullish institutional sign, even as regulatory scrutiny continues to shape capital flows.

Regional dynamics also matter. In emerging markets like Brazil, bank recommendations for small Bitcoin allocations can drive incremental inflows and diversify portfolios against local currency risk. Combined, these factors point to steady maturation of the crypto ecosystem into 2026.

- On-chain indicators: accumulation by long-term holders, reduced exchange balances.

- Institutional moves: ETF access, index inclusions, and cautious public statements.

- Cross-sector activity: crypto capital targeting sports and entertainment deals.

Conclusion

December 2025’s headlines show a market at a crossroads: Bitcoin support near $80,000 gives technical and on-chain buyers a foundation, yet institutional skepticism and regulatory debate will influence near-term flows. Watch ETF flows, index rebalance outcomes, and large corporate moves into sports and entertainment for cues on the next phase of crypto adoption.

Actionable next steps:

- Monitor Bitcoin spot and ETF flows for signs of renewed buying around $80k.

- Track index changes and corporate treasury disclosures to assess institutional exposure.

- Follow regulatory updates that could affect market structure and custody solutions.

Stay informed: Subscribe for daily crypto briefings and real-time price alerts to act on momentum near key technical levels.

コメント