December 3, 2025 Crypto Market Surge: Bitcoin Surge and ETFs Lead Rally Amid Regulatory Advances and Institutional Growth

Snapshot: On December 3, 2025 the crypto market saw a pronounced Bitcoin surge, with BTC reclaiming $93,000 and broad altcoin gains driving renewed investor optimism.

- Introduction

- Key Stories

- 1. Bitcoin Rebounds Above ,000 as Crypto Markets Rally

- 2. Spot XRP ETFs Near Billion Inflows with 12-Day Streak

- 3. UK Enacts Landmark Law Recognizing Crypto as Property

- 4. BlackRock’s Spot Bitcoin ETF Options Rank Top 10 in U.S. Options Market

- 5. MetaMask Launches Transaction Shield with ,000 Loss Guarantee

- Market Analysis — Drivers Behind the Bitcoin Surge

- Risks and Considerations

- Conclusion

- Quick Take: What to Watch Next

- FAQ — Common Questions About the Bitcoin Surge

Introduction

The December 3, 2025 Bitcoin surge kicked off a wide crypto market rally as BTC reclaimed the $93,000 mark and altcoins rebounded. Institutional adoption strengthened, with spot XRP ETFs nearing $1 billion in inflows and BlackRock’s Bitcoin ETF options ranking among the top U.S. contracts. Regulatory clarity — including the UK recognizing crypto as property — further supported sentiment.

Key Stories

1. Bitcoin Rebounds Above ,000 as Crypto Markets Rally

The Bitcoin surge back above $93,000 followed a leverage washout that liquidated roughly $457 million in shorts over 24 hours. This forced deleveraging helped push altcoins higher — SOL, ADA, and XRP each climbed over 12% — while Ethereum avoided deeper downside after touching resistance near $3,000.

2. Spot XRP ETFs Near Billion Inflows with 12-Day Streak

Spot XRP ETFs have recorded a 12-day inflow streak approaching $1 billion, highlighting growing institutional and retail access to XRP via regulated vehicles. These sustained ETF flows are a key driver behind the broader market momentum.

3. UK Enacts Landmark Law Recognizing Crypto as Property

The UK passed the Property (Digital Assets etc) Act with Royal Assent, formally recognizing cryptocurrencies as legal property. This legal clarity is expected to lower execution risk for institutional custody and commercial use of digital assets.

4. BlackRock’s Spot Bitcoin ETF Options Rank Top 10 in U.S. Options Market

BlackRock’s spot Bitcoin ETF options reached roughly 7.7 million active contracts, putting them among the top 10 options products in the U.S. market. Greater options activity enhances liquidity and gives institutions more tools to express macro views on the Bitcoin surge.

5. MetaMask Launches Transaction Shield with ,000 Loss Guarantee

MetaMask rolled out Transaction Shield, promising up to $10,000 in protection for failed transactions or scams. This security enhancement may improve user confidence in DeFi and wallet usage, reducing friction and supporting on-chain activity.

Market Analysis — Drivers Behind the Bitcoin Surge

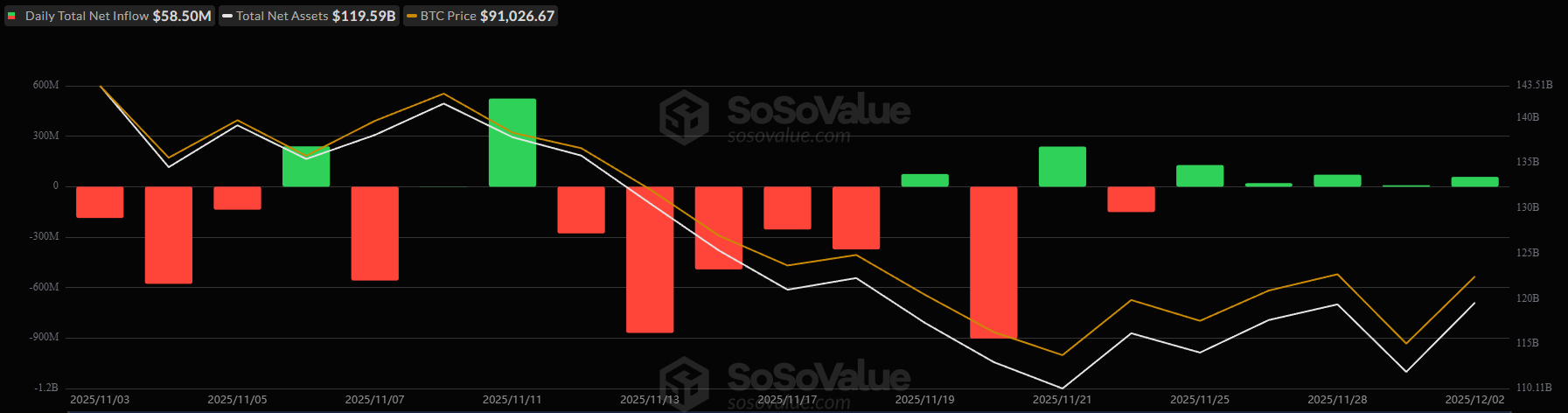

The immediate drivers of the Bitcoin surge include derivative market cleanups, large ETF inflows, and improving regulatory frameworks. Volatility compressed after the washout, enabling a healthier price discovery environment.

Key data points:

- Approx. $457M in short liquidations over 24 hours.

- Spot XRP ETFs nearing $1B cumulative inflows during a 12-day run.

- BlackRock Bitcoin ETF options: ~7.7M active contracts.

- MetaMask offering up to $10,000 in transaction protection.

Altcoins led by Solana, Cardano, and XRP outperformed during the bounce, confirming diversified interest beyond BTC. Ethereum’s brief dip then recovery suggests rotation rather than a systemic sell-off.

Regulatory progress in the UK and regional moves elsewhere (e.g., Taiwan stablecoin frameworks) reduces legal uncertainty, which is often a gating factor for institutional allocation into crypto.

Risks and Considerations

Despite bullish signs, investors should monitor potential headwinds: index rebalances that could remove crypto-related stocks, macro volatility, and liquidity-driven price moves. Use risk management and position sizing when participating in the current Bitcoin surge.

- Watch ETF flow data and options open interest for momentum cues.

- Follow regulatory announcements in major jurisdictions.

- Manage leverage — rapid reversals can occur after large liquidations.

Conclusion

The December 3, 2025 Bitcoin surge underscores a market environment increasingly anchored by institutional products, clearer regulation, and improved user protections. BTC reclaiming $93K set the tone for end-of-year optimism, while ETF inflows and derivatives activity point to deeper market participation.

Looking ahead, continued ETF flows, regulatory clarity, and product innovation (like MetaMask’s Transaction Shield) will shape momentum into 2026. Investors should track technical signals, ETF flows, and policy changes to gauge sustainability.

FAQ — Common Questions About the Bitcoin Surge

Q: What caused the Bitcoin surge on December 3, 2025?

A: The surge was driven by a short squeeze that liquidated roughly $457M in short positions, plus significant ETF inflows and positive regulatory news.

Q: Are ETF inflows sustainable?

A: Spot ETF inflows have been steady, with XRP ETFs showing a notable 12-day streak. Sustainability depends on macro conditions, regulatory clarity, and investor risk appetite.

Q: How should investors respond to high volatility?

A: Use disciplined risk management, consider hedging via options, and avoid excessive leverage during rollovers or index rebalances.

コメント