Ethereum Fusaka Upgrade and Bitcoin Market Shifts Signal New Era in Crypto – December 2025 Highlights

- Introduction

- Key Takeaways

- Main News

- 1. Ethereum Activates Fusaka Upgrade to Boost Network Efficiency

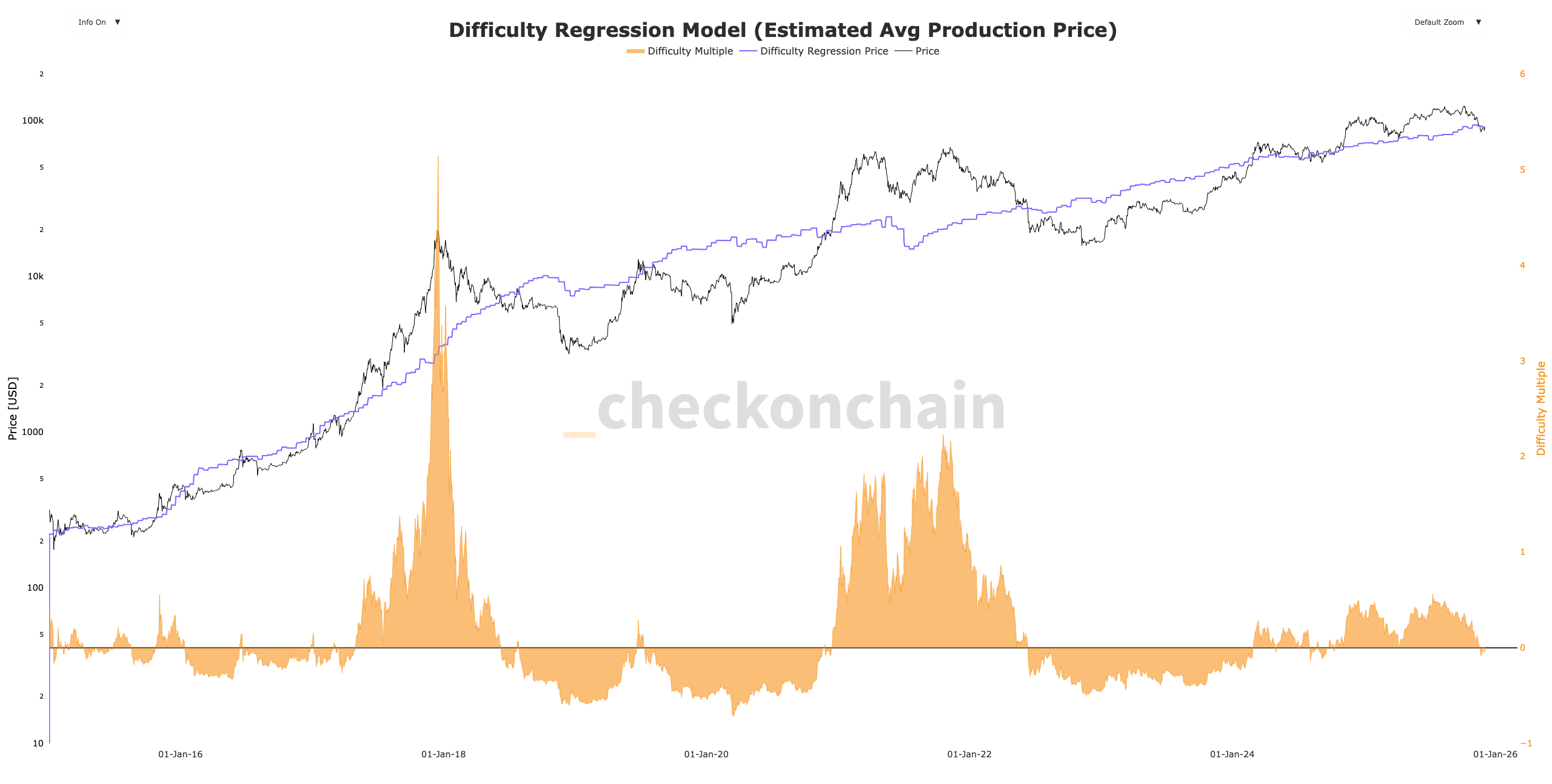

- 2. Bitcoin Market Hovers Near Production Cost, Hinting at Possible Bottom

- 3. Major Banks Run Stablecoin and Crypto-Trading Pilots with Coinbase

- 4. Polymarket Relaunches US App After CFTC Approval

- 5. Crypto M&A Deals Hit Record .6 Billion in 2025

- Essential Market Analysis

- Conclusion

- FAQ

Introduction

Ethereum Fusaka upgrade is live and one of several major developments shaping crypto in December 2025. This article summarizes the Fusaka upgrade, Bitcoin’s price dynamics near production cost, major bank stablecoin pilots, Polymarket’s CFTC-approved relaunch, and record M&A activity — all in concise, actionable points for investors and builders.

Key Takeaways

- Ethereum Fusaka upgrade introduces PeerDAS to cut validator costs and speed layer-2 settlements.

- Bitcoin trading near production cost may indicate a market bottom, though futures backwardation warns of stress.

- Major banks are piloting stablecoin and crypto trading with Coinbase, signaling stronger institutional uptake.

- Polymarket relaunched in the US after CFTC approval, under federal oversight for select markets.

- Crypto M&A topped $8.6 billion in 2025, reflecting consolidation and strategic repositioning.

Main News

1. Ethereum Activates Fusaka Upgrade to Boost Network Efficiency

The Ethereum Fusaka upgrade went live, deploying the PeerDAS system so validators verify small slices of data instead of entire blobs. As a result, validator costs and computational load drop, which should accelerate layer-2 settlements and improve throughput for on-chain finance.

Experts — including Bitwise — say Fusaka stabilizes blob fee economics and brings Ethereum closer to an “instant feel” for users. This upgrade strengthens Ethereum’s position as a high-performance settlement layer for DeFi and institutional flows.

2. Bitcoin Market Hovers Near Production Cost, Hinting at Possible Bottom

Bitcoin’s price is trading near estimated production cost (roughly $90,000 by some network models), which may act as a fair-value support. This proximity often tightens the bull/bear threshold and can mark bottoms.

However, futures show deep backwardation — the largest since FTX — indicating market stress and cautious positioning. Investors should watch miner behavior, on-chain flows, and funding rates for confirmation of a sustained rally.

3. Major Banks Run Stablecoin and Crypto-Trading Pilots with Coinbase

Coinbase CEO Brian Armstrong confirmed that several large U.S. banks are running pilots to integrate stablecoins and crypto trading using Coinbase infrastructure. This reflects growing institutional interest in tokenized cash and digital asset custody.

Notably, BlackRock’s Larry Fink also noted Bitcoin’s utility at the DealBook Summit, signaling a more constructive view from traditional asset managers. These pilots could accelerate on-ramps for institutional flows.

4. Polymarket Relaunches US App After CFTC Approval

Prediction market platform Polymarket relaunched its US mobile app after receiving CFTC oversight to allow select users to trade on sports and proposition markets. This move blends decentralized prediction markets with federal regulatory frameworks.

Regulated entry into the US may broaden adoption and sets a precedent for other crypto-native products seeking compliance.

5. Crypto M&A Deals Hit Record .6 Billion in 2025

Despite volatility, strategic consolidation drove crypto M&A to a record $8.6 billion in 2025. Firms are buying scale, talent, and regulatory pathways to position for the next cycle.

Watch how these deals influence liquidity, product roadmaps, and competition across exchanges, custody providers, and DeFi infrastructure.

Essential Market Analysis

The Ethereum Fusaka upgrade should improve validator economics and encourage more layer-2 activity, which can reduce gas friction and boost DeFi throughput. In short, Fusaka improves both cost-efficiency and user experience.

Meanwhile, Bitcoin’s proximity to production cost is a constructive signal, yet futures backwardation suggests persistent risk. Institutional pilots and regulatory approvals — like the bank pilots and Polymarket’s CFTC clearance — are gradually lowering barriers between traditional finance and crypto.

Overall, these developments favor a gradual shift toward mainstream integration, though liquidity and volatility will remain important near-term factors.

Conclusion

The Ethereum Fusaka upgrade is a landmark technical improvement that reduces validator costs and accelerates layer-2 settlement, reinforcing Ethereum’s role in on-chain finance. Bitcoin trading near production cost highlights potential value stabilization, while deep backwardation advises caution.

Institutional pilots with Coinbase and regulated product relaunches like Polymarket’s US app demonstrate growing mainstream acceptance. With M&A activity hitting record levels, the industry is realigning for scale and compliance heading into 2026.

Call to action: Stay informed — subscribe for weekly crypto analysis and on-chain alerts to track Fusaka adoption, Bitcoin risk signals, and institutional flow developments.

FAQ

- What is the Ethereum Fusaka upgrade?

- Fusaka introduces PeerDAS, enabling validators to verify slices of blob data instead of full blobs, reducing costs and improving layer-2 settlement speed.

- Does Bitcoin trading near production cost mean the bottom is in?

- Not necessarily. Proximity to production cost can signal fair value support, but futures backwardation and on-chain flows should be monitored for confirmation.

- Are major banks adopting crypto in production?

- Several US banks are running pilots with Coinbase for stablecoins and trading infrastructure, indicating experimental institutional adoption rather than full production rollouts yet.

- Why is Polymarket’s relaunch significant?

- CFTC oversight for Polymarket’s US app shows a pathway for crypto-native platforms to operate under federal regulation, which could expand mainstream access to prediction markets.

コメント